MyKredit Cloud Lending Platform for Kredit Komuniti

Faster Lending.

Cleaner Compliance.

Better Control.

Manage borrower onboarding, loan origination, repayment schedules, collections and reporting in one secure cloud system — built for operational speed and audit readiness.

- ✅ Automated repayment schedules, receipts & arrears tracking

- ✅ KPKT Agreement Jadual J & K, receipts & statutory documents

- ✅ KPKT-compliant controls, BNM / AMLA–aligned with PDPA-aligned data handling

- ✅ E-Invoice API–ready integration with full ledger reporting

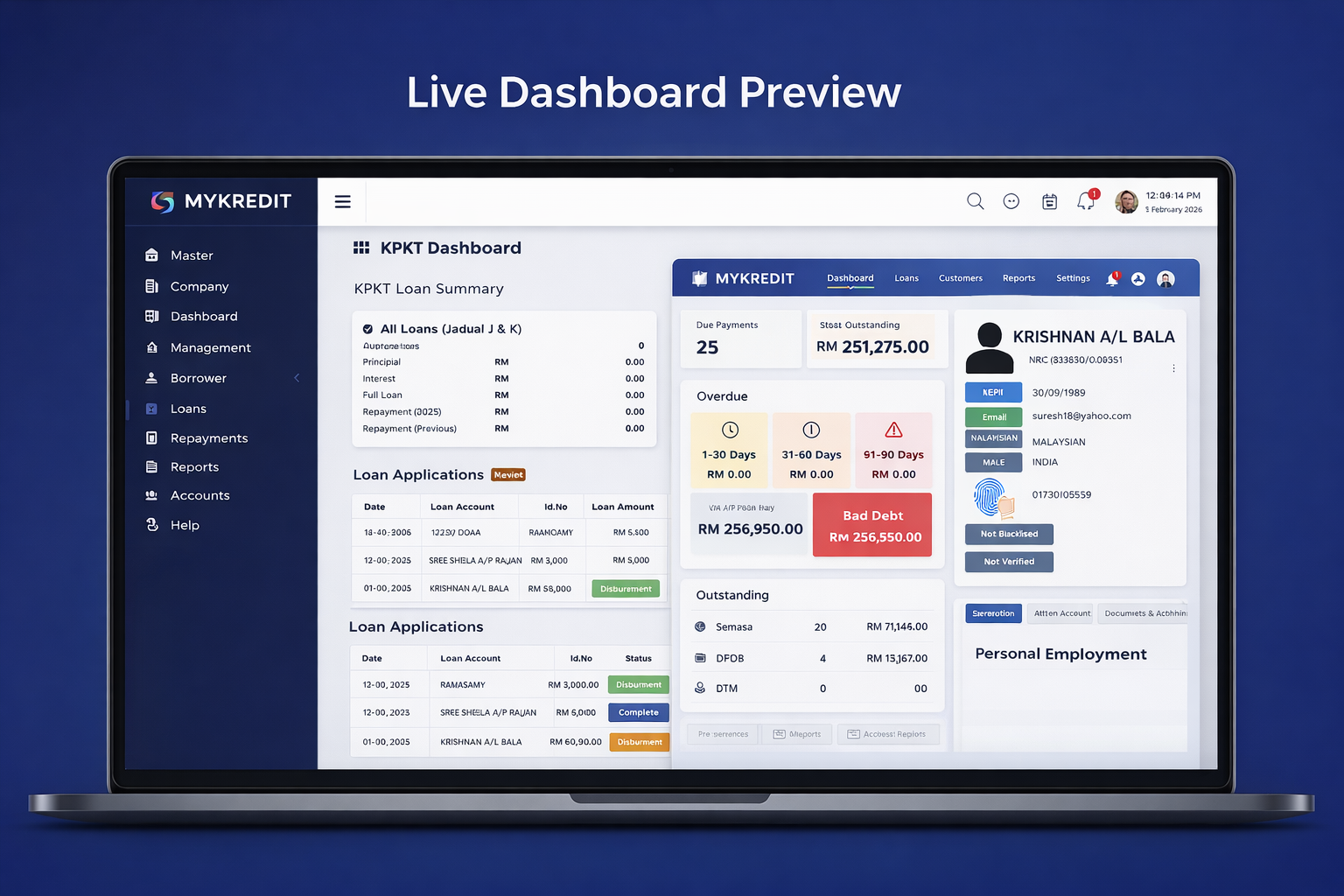

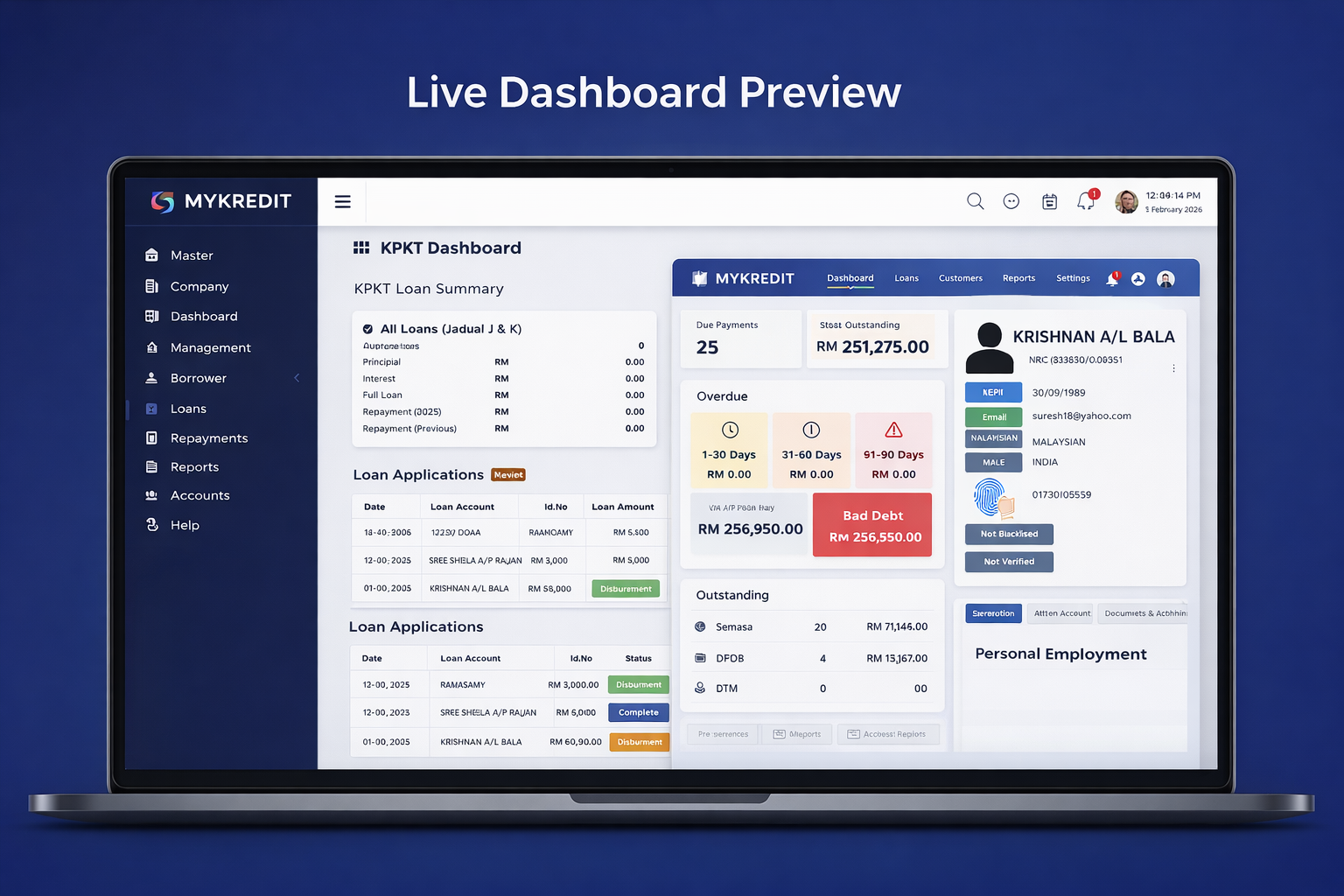

Dashboard Preview

Cloud • Secure

Faster Processing

Auto

Audit Readiness

Logs

Any Device

Cloud

Simplify & Streamline Your Lending Process

A modern cloud platform built for Kredit Komuniti lenders — manage borrower onboarding, loan origination, repayment schedules, collections and compliance reporting in one system.

Designed to reduce manual work, standardise documentation, and give you real-time visibility into arrears, portfolio performance and operational health.

Automation

Auto schedules, late-fee rules and reminders.

Role-Based Access

Users, branches and permissions with logs.

Collections

Arrears tracking + follow-up visibility.

Compliance Ready

Templates & exports aligned to KPKT workflow.

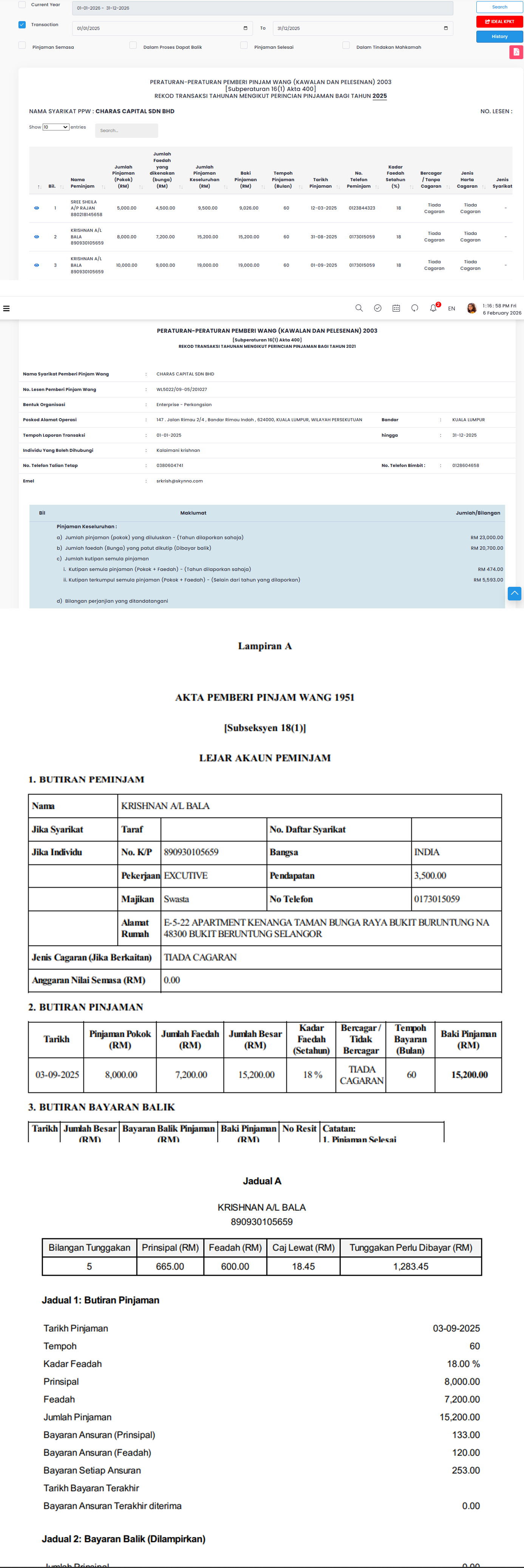

Compliance reporting coverage

Generate and export KPKT-ready reporting documents with consistent formatting and clear borrower records — built to support audits, yearly submissions and operational controls.

Jadual A

Legal reporting statement for defaulters (structured summary for review and submission).

Lampiran B

Yearly submission to KPKT summary (portfolio totals, counts, key movements).

Lampiran B1

Yearly submission borrower name list (clean export for reconciliation and checking).

Lampiran A

Borrower statement of account (KPKT format with repayment history and balances).

Tip: You can generate reports by branch, date range, loan status and borrower type — helpful for internal checks and year-end submission.

Standardised documents • KPKT-ready exports • Fast generation • Clear borrower records

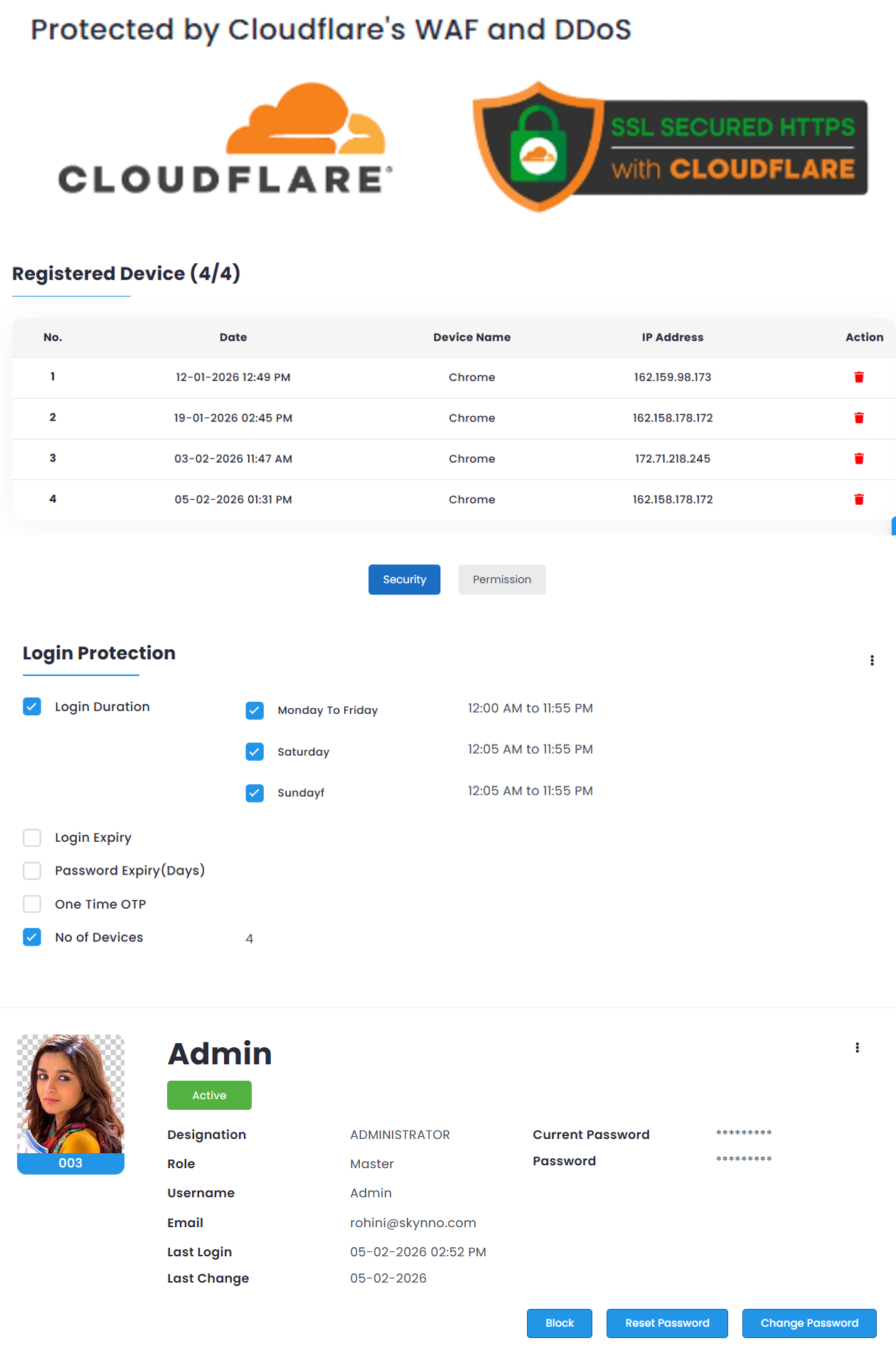

Security preview

Security Center

Security & Data Protection

We prioritise data protection with encryption, secure access controls and continuous monitoring. All connections use HTTPS (TLS), with strict transport security and multi-factor authentication for administrators.

MyKredit is designed with practical security controls for lending operations: role-based access, audit trails, and data handling practices aligned with PDPA principles. Sensitive records can be restricted by branch, user role and workflow stage.

Access control

Role-based permissions for staff, branches and admins.

Audit readiness

Activity logs for logins, record updates and report exports.

Encryption

TLS in transit, plus secured storage practices for records.

Operational security

Session controls, strong passwords and admin MFA support.

Security practices include:

- ✅ Least-privilege access for users and branches

- ✅ Clear audit logs to support reviews and compliance

- ✅ Controlled exports for reports and documentation

- ✅ Secure admin access with MFA and monitoring

PDPA-aligned handling • Role-based controls • Audit trails • Secure access

Security preview

Security Center

Subscription Plans

Choose the plan that fits your business. All plans include a one-time setup fee covering server configuration, domain and SSL. Contact us for a detailed quote.

Customised

Tailored features & API

Dedicated/High-End Servers

Account/E-Invoice Integration

Get QuotePlan Features & Details

General Features

- ✔️ Individual & company loans

- ✔️ Borrower profiles & tagging

- ✔️ Custom reporting & branding

- ✔️ MyKad reader & thumbprint verification

- ✔️ Multi-user roles

Compliance & Reports

- ✔️ iDaman submission, Lampiran A/B/B1

- ✔️ Jadual A, J, K agreements

- ✔️ Dual-language agreements & consent letters

- ✔️ Licence transaction reports

Accounting & E-Invoice Ready

- ✔️ Borrower & collection ledgers

- ✔️ Ledgers by month, year and status

- ✔️ E-Invoice API integration

- ✔️ Post loan & repayment information

- ✔️ Modify invoices

Let’s Build Your Success Together

Get a free, customised quote. We’ll recommend the best plan based on your active loans, workflow and reporting needs.

What you’ll get in the demo

- ✅ Workflow walkthrough (borrower → loan → repayment)

- ✅ Compliance & document generation overview

- ✅ Reporting & arrears tracking dashboard

- ✅ Pricing + recommended plan

Fast contact

Prefer WhatsApp? Tap to message us.

WhatsApp NowTypical response: within 1 business day

Privacy Policy (Summary)

We collect the details you submit (company, contact and message) only to respond to your enquiry. We do not sell your data. Access is restricted to authorised personnel.

For full policy wording, replace this section with your official PDPA notice (and add a separate privacy page if needed).